Consistent project analysis helps you make the right choices at the right time, leading you towards a more successful outcome and the highest possible ROI.

This is why you need project analysis.

It is assessing every expense or problem related to a project before working on it and evaluating the outcome once the work is done.

How to do project risk analysis?

This is where understanding the longest chain of dependencies or the project's critical path becomes very important. Any delay in the critical path would ultimately lead to missed deadlines.

Before any executive gives the green light to a project that could cost thousands (or millions) of dollars, you can bet they will want to see a feasibility study.

Key points of a feasibility study.

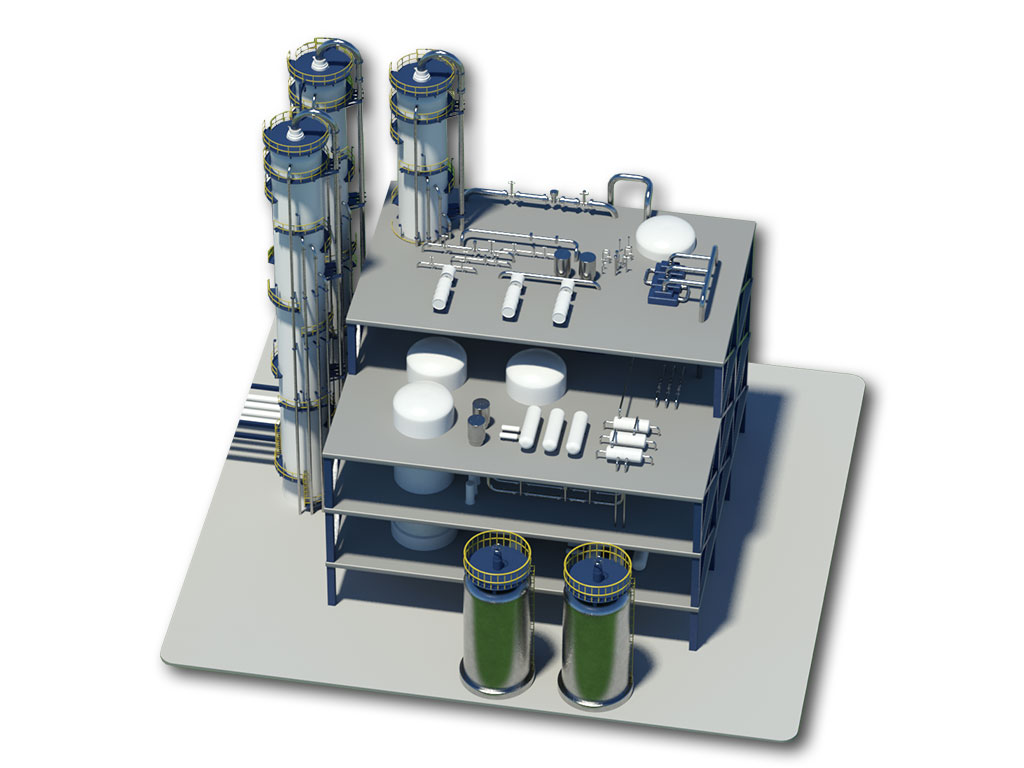

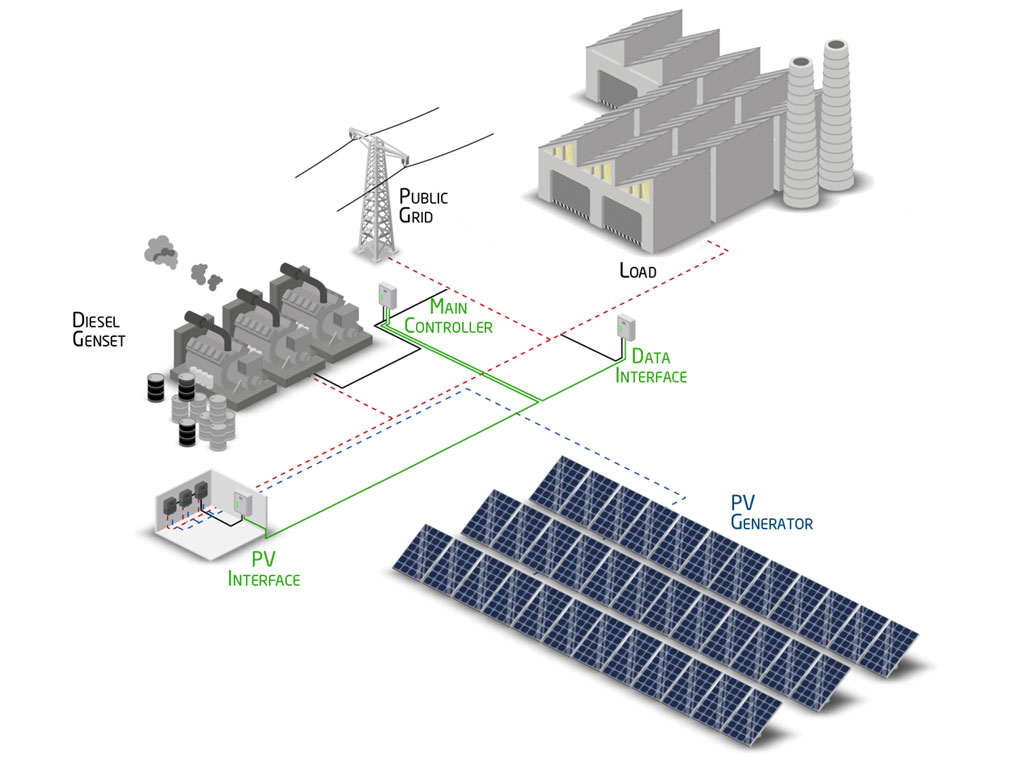

Technical capability: Does the organization have the technical resources to undertake the project?

Budget: Does the organization have the financial resources to undertake the project, and is the cost/benefit analysis sufficient to warrant moving forward?

Conducting a feasibility study.

Preliminary analysis: Before moving forward with the time-intensive process of a feasibility study, many organizations will conduct a preliminary analysis, which is like a pre-screening of the project. The preliminary analysis aims to uncover insurmountable obstacles that would render a feasibility study useless. If no major roadblocks are uncovered during this pre-screen, a more intensive feasibility study will be conducted.

Project finance management is a critical aspect of effective project management, as it focuses specifically on vital business metrics.

Selecting the right financial metrics.

Project managers should focus on a few critical financial metrics that are essential to specific business cases. Revenue, operational costs, profitability, and earned value.

Focusing on project ROI.

By refining financial management focus towards ROI, projects can be executed in a leaner and agile way, driving better results for stakeholders.